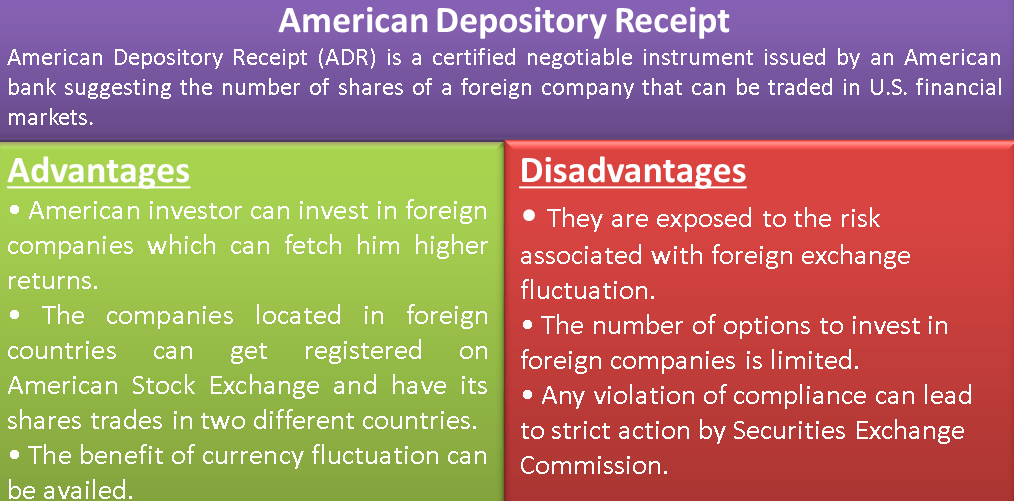

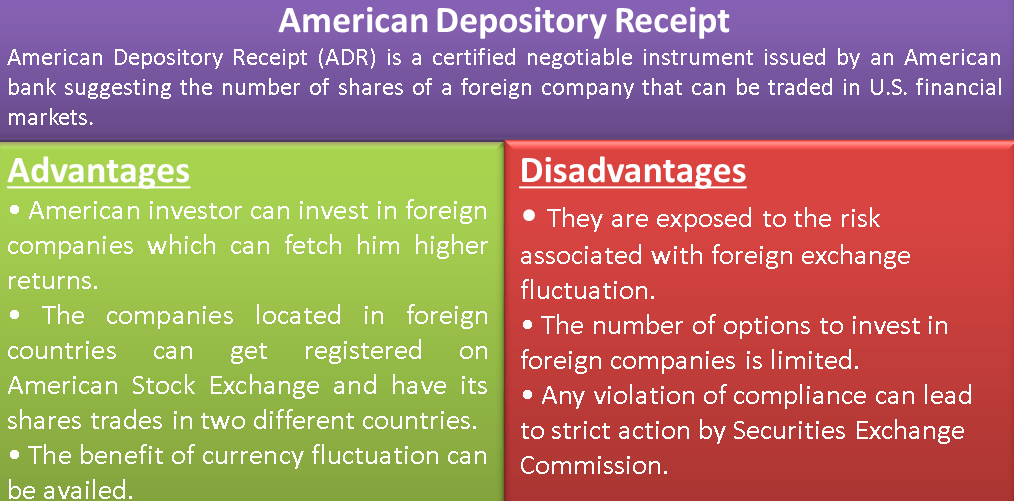

What Is an American Depositary Receipt – ADR?

An American depositary receipt (ADR) is a negotiable certificate issued by a U.S. depository bank representing a specified number of shares—often one share—of a foreign company’s stock. The ADR trades on U.S. stock markets as any domestic shares would.

ADRs offer U.S. investors a way to purchase stock in overseas companies that would not be available otherwise. Foreign firms also benefit, as ADRs enable them to attract American investors and capital without the hassle and expense of listing on U.S. stock exchanges.

美国存托凭证是美国商业银行为协助外国证券在美国交易而发行的一种可转让证书。通常代表非美国公司可公开交易的股票和债券。股票通过美国存托凭证方式上市有以下优点:提高发行公司在国外市场的知名度,拓展境外筹资渠道,为日后直接在美国市场发行证券奠定基础。具有比一般股票更高的流动性。不仅存托凭证之间可互换,也可与其他证券互换。降低交易成本。美国存托凭证大多在美国证券交易委员会注册,被看作是一种美国证券,可以在美国的证券交易所市场或柜台交易市场进行自由交易,便于非美国公司进入美国证券市场。

American Depository Receipt (ADR) Process

- The domestic company, already listed in its local stock exchange, sells its shares in bulk to a U.S. bank to get itself listed on U.S. exchange.

- The U.S. bank accepts the shares of the issuing company. The bank keeps the shares in its security and issues certificates (ADRs) to the interested investors through the exchange.

- Investors set the price of the ADRs through bidding process in U.S. dollars. The buying and selling in ADR shares by the investors is possible only after the major U.S. stock exchange lists the bank certificates for trading.

- The U.S. stock exchange is regulated by Securities Exchange Commission, which keeps a check on necessary compliances that need to be complied by the foreign company.

Advantages of American Depository Receipt (ADR)

Following are the advantages of ADRs:

- The American investor can invest in foreign companies which can fetch him higher returns.

- The companies located in foreign countries can get registered on American Stock Exchange and have its shares trades in two different countries.

- The benefit of currency fluctuation can be availed.

- It is an easier way to invest in foreign companies as there are no restrictions to invest in ADR.

- ADR simplifies tax calculations. Trading in shares of foreign company in ADR would lead to tax under US jurisdiction and not in the home country of company.

- The pricing of shares of foreign companies in ADR is generally cheaper. Hence it provides additional benefit to investors.

Disadvantages of American Depository Receipt (ADR)

The following are the disadvantages of American Depository Receipts:

- Even though the transactions in ADR take place in US dollars, still they are exposed to the risk associated with foreign exchange fluctuation.

- The number of options to invest in foreign companies is limited. Only a few companies feel the necessity to register themselves through ADR. This limits the choice available to US investor to invest.

- The investment in companies opting for ADR often becomes illiquid as an investor needs to hold the shares for the long term to generate good returns.

- The charges for the entire process of ADR are mostly transferred on investors by foreign companies.

- Any violation of compliance can lead to strict action by the Securities Exchange Commission.

Conclusion

1. ADRs provide the US investors with ability to trade in foreign companies shares.

2. ADR makes it easier and convenient for the domestic investors in US to trade in foreign companies shares.

3. ADR provides the investors an opportunity to diversify their portfolio by investing in companies which are not located in America. This eventually leads to investors investing in companies located in emerging markets, thereby leading to profit maximization for investors.

HOW TO APPLY?

You can apply for our tailor-made American Depository Receipt (ADR) by contact:

Mr. Bill Wren

WeChat: billwren

Cell/SMS/WhatsApp: +86 – 186 5206 1897

Email: bill(dot)wren#wrencapital(dot)me

**Notice: When 👆Email, please change “ (dot) ” to “ . “; change ” # ” to “ @ “